When it comes to forex trading, Singaporean traders need to be aware of the government bond market because it can significantly impact the currency market. The government bond market can affect currencies because it represents the size and health of a country’s economy. A large, healthy bond market means a country is doing well economically and can pay its debts, leading to a strong currency.

The impact of the bond market on Singapore

The bond market can significantly impact Singapore due to the size of the country’s economy. Singapore’s economy is an open economy. Its currency is peggedto the US dollar, meaning that changes in the bond market can directly impact the Singaporean currency.

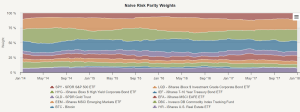

The yield on government bonds can also have an impact on Singapore’s currency. When yields are high, investors are willing to take on more risk to earn a higher return, leading to a strong currency as investors seek to invest in riskier assets.

Lastly, the bond market can affect Singapore’s currency through central bank policy. The central bank in Singapore is the Monetary Authority of Singapore (MAS). The MAS uses bonds to implement monetary policy. For example, if the MAS wants to increase the money supply, it will purchase bonds, leading to an increase in currency circulation, causing the currency to weaken.

The benefits of investing in government bonds

Investing in government bonds is beneficial. First, government bonds are considered safe investments because the governments that issue them are unlikely to default on their debt payments, making them a good investment for risk-averse investors looking for a safe place to park their money.

Another benefit of investing in government bonds is that they offer a fixed rate of return, meaning investors know exactly how much interest they will earn on their investment over the bond’s life.

Lastly, government bonds can be used as a hedge against inflation. When inflation rates rise, the prices of goods and services increase. Government bonds typically offer a higher rate of return than inflation, which means that they can help to offset the effects of inflation.

How to trade forex while considering government bonds in SG

Determine your investment objectives

When trading forex, you must determine your investment objectives. Do you want to make a profit quickly, or are you looking to invest for the long term? Your answer will dictate what kind of strategy you need to use.

You will need to use a more aggressive strategy to make a quick profit. It could involve taking on more risk and utilising leverage.

If you are looking for a long-term investment, you must use a more conservative strategy.

Choose a currency pair

After determining your objectives, you must choose a currency pair. The most favoured pairs are EUR/USD, GBP/USD, and USD/JPY. These pairs are the most traded and, therefore, the most liquid, meaning you can buy and sell them more easily without worrying about getting stuck in a position.

Consider the government bond market

When trading forex, it is essential to consider the government bond market because the bond market can have an impact on currency prices. For example, if the MAS is buying bonds, this will increase the money supply and could cause the currency to weaken. However, if the MAS sells bonds, this will decrease the money supply and could cause the currency to strengthen.

By considering the government bond market, you can better understand where the currency is headed and make more informed trading decisions.

Use a risk management strategy

It is essential to use a risk management strategy when trading forex. It will help you to protect your capital and minimise your losses. One way to manage your risk is to use a stop-loss order, which is an order that will close your position automatically if it goes against you by a certain amount. A stop-loss order can limit your losses and give you some breathing room.

Another way is to variegate your portfolio, which means investing in different asset classes, such as stocks, bonds, and commodities.

Start trading

You should be ready to start trading. Don’t try to make too many trades all at once. Instead, focus on making a few good trades that will make you money in the long run.

If you want more information, you can get it from here.