ESG Investing and Portfolio Management

7 min read

ESG investing and portfolio management are growing in popularity. This type of investing is designed to give investors a more holistic view of a company’s performance. It also helps to mitigate risks. For instance, ESG factors can help to screen investments that do not meet pre-existing standards.

ESG factors give investors a more holistic view of a company’s performance

An ESG factor is a factor pertaining to a company’s sustainability efforts, environmental impact, or governance practices. This data is a powerful tool for investors to evaluate a company’s performance and determine whether it aligns with their values.

A number of studies have shown that investing in ESG factors improves investment returns. Some of the key criteria include ethical executive compensation, environmental footprint, and social inclusion. The key to successful ESG investing is a holistic integration of these factors. Using this approach can lead to superior valuations and more sustainable companies.

An increasing number of businesses are using ESG factors to assess their performance. They’re also addressing challenges related to carbon footprints and diversity. These data can be combined with other information, including financial data and industry benchmarking.

As these companies have more reliable data, it is becoming easier for investors to make sound investment decisions. Companies can use this information to mitigate risk, track progress, and find growth opportunities.

A recent study found that companies in the top quintile for ESG factors outperformed those in the bottom quintile by 25 percentage points. This is because of the fact that the stock prices of companies in the top quintile tend to be less volatile.

According to Elizabeth Lewis, Managing Director of ESG at Blackstone, integrating these factors into a company’s investment strategy can lead to a variety of positive outcomes. She notes that an ESG specialist should have a comprehensive understanding of the various ESG criteria.

ESG specialists can work with private and public companies. They may also work with investment banks or institutional investors.

ESG specialists can help companies develop and implement programs that promote carbon neutrality and other sustainability goals. For example, a company’s carbon footprint can be broken down into emissions from energy use, direct greenhouse gas emissions, and emissions from the supply chain.

ESG factors can mitigate risk

ESG (Environmental, Social, and Governance) factors can help to mitigate risk when investing and portfolio management. They can be used to gain a holistic view of a company and identify opportunities for growth. However, they also need to be used throughout the investment cycle.

Investing in ESG can be a great way to align your portfolio with your values. It can reduce your portfolio’s risk, enhance your returns, and allow you to generate measurable social and environmental outcomes. However, it can be tricky to know which approach is best for your individual portfolio.

ESG factors can help to determine whether a firm is environmentally friendly, a good corporate citizen, or both. By using a holistic view of a company, you can avoid making investments that don’t address the concerns of the stakeholders.

The ESG movement has changed the way large investors consider risks. Companies are now making more disclosures about their sustainability initiatives in their annual reports. This helps investors assess a firm’s ability to meet their needs and minimize the impact of negative incidents. Moreover, investing in firms that are ethically and professionally managed can be beneficial in the long run.

Many companies have faced major ethical breaches in recent years, such as BP’s 2010 Gulf of Mexico oil spill. These incidents can create a ripple effect on a stock’s price. In the worst case scenario, a controversy can wipe out billions in shareholder value.

Although ESG factors have become more commonplace in routine investment decisions, investors need to understand how they affect a company’s performance. ESG issues can have important implications for a company’s performance, so it’s crucial to conduct thorough research and check internal controls.

ESG factors can be used to screen investments that don’t adhere to pre-existing standards

Generally speaking, ESG (Environmental, Social, and Governance) investing is the use of financial resources to fund companies that demonstrate high standards for social and environmental performance. However, ESG investments are not well defined. There are several ways to identify them. Depending on how you define them, they may offer a significant advantage to investors.

There are many investment products that employ ESG principles. Some of them include mutual funds, ETFs, and robo-advisors. These products can help investors diversify their portfolios and reduce the risk of buying stocks that are unsuitable.

For example, the ESG score of a company can be an indicator of its environmental performance, such as its carbon footprint or recycling practices. Companies with higher scores tend to be more eco-efficient, which means they have better gross margins and deliver more profit.

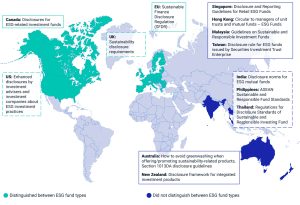

Likewise, a company’s sustainability report can help you identify opportunities. Many firms are now making disclosures in their annual reports. In addition, the use of ESG metrics is growing in the financial industry.

The S&P Dow Jones Indices is probably the most well-known provider of ESG research. They publish ratings for more than 8,500 companies worldwide. Most ESG scores follow a 100-point scale.

Other companies provide lists of the best ESG-rated stocks. Investors can then build an asset allocation strategy using these lists. Alternatively, they can use a financial advisor or do-it-yourself research to identify investments.

ESG investing also allows investors to avoid companies that engage in unethical or harmful behaviors. Some investment professionals have labeled them as concessionary.

A recent study compared the performance of stocks that have a higher ESG score with those that do not. It found that 75 percent of firms did not see any material improvement. This makes it difficult to choose the best of the bunch.

ESG factors are integrated into the investment process

Environmental, Social, and Governance factors are integrated into the investment process in a number of ways. This enables investors to express their values and reduce their downside risk. It also helps ensure savings reflect their preferences.

As a result, companies that meet higher environmental standards and have a good reputation tend to do better in the long term. A company that does not align its values with those of its customers may lose customer loyalty.

ESG factors include corporate climate change response, water management, and corporate worker treatment. These criteria are used by equity and fixed income managers to identify good businesses. However, these factors are not necessarily uniform. Each company and sector is evaluated differently.

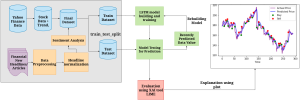

A comprehensive approach integrates ESG factors into the valuation and forecasted financials of the company or bond issuer. It can involve adjusting the fair value of the financials to incorporate the ESG factor. Alternatively, it can involve incorporating the ESG factor into the dividend discount model or discounted cash flow model.

Companies that meet higher environmental standards have fewer accidents, higher customer loyalty, and may have a higher level of product quality. In addition, companies that have better environmental practices are more profitable.

As an example, a company’s commitment to reducing carbon emissions is viewed as a financial ESG factor. On the other hand, a company’s support for offensive causes is likely to hurt its bottom line.

While ESG factors can be considered in the same way as other financial factors, there is no guarantee that the evaluation of these characteristics will have an additive effect. Furthermore, it is important to note that information on these factors is not always available. Hence, fully integrating these factors can take time.

Barriers to ESG investing and portfolio decarbonization

Investing in ESG (environmental, social, and governance) is an important part of the investment universe. However, investors may be unsure if they’re doing it right. Here are a few ways to help you make informed decisions about your investments.

ESG data is critical to effective decision-making. However, many institutions struggle with quality and data consistency. This can result in inaccurate target-setting and reporting, which can have a negative impact on overall performance.

As investors and companies strive to decarbonize their portfolios, they’ll have to consider how to manage the risks associated with the transition. Companies that haven’t yet set formal targets will need to take bold steps in order to stay on track. Fortunately, the momentum is increasing.

In a recent survey of 325 institutional investors, PwC found that many of them were actively engaging with invested companies to better understand their sustainability practices. A large number were also actively integrating ESG into their investment analysis.

The survey results indicate that a majority of respondents prioritized ESG goals in their portfolios, but many still have reservations about the quality of the data they receive. Additionally, investors are hesitant to include sustainable assets in their portfolios. But as governments and businesses continue to take note of the data that is being collected, there’s a growing sense that the world is shifting.

Asset stewardship and engagement is more important than ever. It’s crucial to understand how the market performs and how to best leverage it. Educating your stakeholders about the market will go a long way towards breaking down investment barriers.

One key to moving the needle is a broader audience, and more relevant reporting. Governmental authorities can help by making their sustainability data more accessible. Investors and companies can use this information to better meet their regulatory obligations.