Understanding Forex Market Sentiment

4 min read

Market sentiment represents the collective image that you, Warren Buffett, Celine from the donut shop and millions of other market traders hold in their minds about the various currency pairs. Knowing what market sentiment is saying about what you should be buying or selling in any region is helpful to identify if a particular region of this market has come too far and can’t go any further (this means it’s ripe for a reversal).

Others trade sentiment indicators the opposite way. Many systems will go long when sentiment is rising and short when sentiment is below a particular threshold.

Fundamentals

Fundamentals or economic factors that affect currency pairs valuation are economic conditions, monetary policy changes or decisions made by the central banks, and political events in different countries. These can be a major cause of variations in market sentiment and price actions of currency pairs in the forex market.

While news and economic data reports don’t tell you directly what’s going to happen tomorrow, many traders use them as a guide to what’s going on underneath. This includes not only the government reports of GDP, employment, CPI and wage growth but also the numerous consumer and business sentiment surveys that give some idea of what people expect the future to hold.

Another form of fundamental analysis takes the form of sentiment analysis – that is, taking into account what traders are doing on a particular currency pair. For example, if 90 per cent of traders are long dollars against Japanese yen and short against the British pound, this might constitute positive or negative sentiment for the broader market. Your broker provides a COT report that allows you to see overall trader sentiment – that is, if net long or short positions, across both commercial and non-commercial traders, are greater in one currency than the other.

Volume

This way, currency pairs are interpreted by traders through the prism of how many positions were taken to buy or to sell it. If buy volumes gain the upper hand over sell volumes, for instance, this might be a hint that this currency is getting ready for a bullish uprun with the aim to push prices; similarly, if long positions outweigh short positions, then the market is considered bearish with the possibility to take the opposite course of action, betting against it and coming up ready when it has opportunities opened up to make a buck out of it.

A key thing to remember is that whereas trading in the stock markets is concentrated in one place – an exchange – forex trading is over-the-counter (OTC), and this can make it harder to judge the mood or read sentiment. An indicator based on client orders as provided by brokers and other sources can help here because you can see when readings are getting extreme and a reversal, well, might be approaching.

Open Interest

Open interest is a useful sentiment and trend-indicator that refers to the cumulative total of not-yet-taken-out (delivered) futures contracts or not-yet-exercised (or ‘closed’, with the payment of the premium) options ones, whose total grows as new positions are opened and declines as old ones are closed out.

Another way traders lever OI to anticipate price changes is that, generally, the more contracts that are opened, the higher the trading volume will be, so if a new position is opened in a daytrade, the trading volume will likely increase and vice versa. However, keep in mind that, even though OI is a common way to project trading volume, it is not a true measure of trading volume because OI does not actually reflect trading volume. To see if OI truly increases or decreases, whether some of the contracts that were created were filled or not, one has to compare OI for each contract over time with actual trading volume.

Unless otherwise noted, a high open interest suggests that there’s a good portion of speculative buyers present; in this way, it’s often consistent with a present trend continuing and might signal its continuation, though a drop off could indicate a reversal; as a result, I would advise cross-referencing open interest with other fundamental and technical data, and I’d certainly continue to read the news to see the way that markets react to new developments.

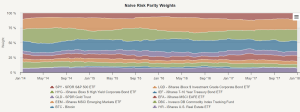

Broker Sentiment

Lots of the forex traders use sentiment indicators of the market as an additional source of information to help them predict price changes. Sentiment analysis can be an efficient complimentary tool both for fundamental analysis and technical analysis.

Namely, one of the most popular sentiment indicators is the VIX – a kind of options price-tracking volatility index that attempts to reflect implied volatility: a number taken from options prices. This VIX, however, does not reflect the sentiment of all traders. In fact the VIX might be biased. The other most popular is from charting package Myfxbook Sentiment Meter, which it goes on to display placed somewhere on your charts – the ratio of traders long versus those short on different Forex instruments. But this represents just traders who freely plugged in their accounts and nothing more.

Different traders use the sentiment indicators in the opposite attitude and trade against this sentiment (so-called “contrary to the crowd” traders) here if everyone is long on EUR/USD, then this might be a sign of an overcrowded situation in which you should go short on this pair, but this is a different topic that requires much more knowledge of Forex market sentiment which we will cover after graduating from School!