Forex Trading and Technology Failures – A Study of Operational Risk

3 min read

The forex market is a very risky market that not only offers massive potential for profit but it also carries massive losses. Poor knowledge and risk management can cause bad trading behavior and expensive errors with necessary corrective measures.

The causes of operational risks usually lie within, such as a faulty system, human mistakes or poor business decision-making; but they can also come from the outside, such as a natural disaster or political change.

Lack of Education and Knowledge

Forex trading can be a very complicated and risky business, but with the potential profits you can get worth it. But the fact is that without proper information, these traders could miss this opportunity at the greatest level; going down the path of poor decisions, risk-taking and emotional trading.

Fundamental and technical analysis lie behind false readings of market signals which produce negative trading outcomes such as overtrading and paying high spread and commission costs that consume profits or compound losses. To stay out of this mess traders can get more informed and develop trading strategies taking into consideration risk, reward and volatility to trade the volatile forex market confidently.

Poor Risk Management

Forex is high risk, and when done wrong, you could experience big losses that eat away at your trading account and take away its stability.

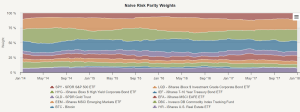

Effective risk management strategies can help you prevent losses. They include position sizing, which enables you to determine an appropriate size of a trade based on your trading capital and risk tolerance; and hedging, which involves opening offsetting positions to counteract adverse price movements as another effective method for mitigating risk.

Stress management strategies can also help you stay emotionally balanced and more objective when it comes to trading. What’s more, by staying on a continuous learning curve and listening to the counsel of seasoned traders, you’re constantly able to adjust your trading and risk management habits and improve performance.

Emotional Decision Making

Trading in forex can be emotionally exhausting. The four emotions: fear, greed and hope all distort judgment and make quick-hit decisions with a high price tag. Using good emotions management methods will empower traders to get better and succeed over the long run in this volatile forex market.

The number one mistake that can destroy the trading success of a trader is excessive leverage. For example, 100:1 leverage traders have to take a huge risk each time they make a trade, and even a small movement against them can blow up their entire account.

To evade this kind of loss, traders should always use stop-loss orders and check their risk management policies prior to placing any trade. And they also need to learn from the trading experience in which they keep a trading diary that allows them to see the mind, feelings and intention of each trade they made.

Overtrading

It is extremely risky trading in forex, traders lose the entire portfolio after a single bad trade. Furthermore, traders overtrade on whims by taking trades based on the market or sentiment and do poorly due to poor discipline or execution without a trading plan.

In addition to risking losing money overtrading can also make it significantly more expensive to trade. Every trade has spreads and commissions which quickly add up – at some point these can take away any gains you have and it’s expensive to trade.

As too much trading can easily result in a company growing beyond their capacity, creating cash flow problems and unpaid debts, that is also a potential business challenge.

Lack of Adaptability

Traders will have to change trading techniques very quickly to stay competitive in the face of ever-changing market trends. Market conditions could fluctuate with economic news, geopolitics and investor sentiment leading to sharp market movements that need constant adjustment by traders.

Risk is of utmost importance in the forex trading. Account balance, leverage, volatility and correlation are all factors traders should look at while deciding on positions to reduce risk of losses.

Successful traders understand that error is a learning curve and they look at it critically to see what can be improved. Using their experience as an opportunity to polish the traits that work and practicing frequently they keep their skills fresh.