Risk Parity Portfolio Construction Methods: A Practical Guide

5 min read

Let’s be honest. The classic 60/40 portfolio—60% stocks, 40% bonds—feels like a comfortable old sweater. It’s familiar. But what happens when that sweater starts to unravel? When stocks tank, that 60% slice can dominate your portfolio’s losses, leaving the 40% in bonds feeling… well, a bit useless as a counterweight.

That’s the exact problem risk parity aims to solve. Instead of allocating capital based on dollars, it allocates based on risk contribution. The goal? To build a portfolio where each asset class contributes equally to the overall volatility. It’s a bit like building a balanced team where every player carries the same defensive load, not just gets the same salary.

The Core Idea: It’s All About Balance, But Not the Kind You Think

Traditional portfolios are balanced in terms of money. Risk parity portfolios are balanced in terms of fear—or more precisely, volatility and potential loss. The big insight here is that a dollar in bonds is not the same as a dollar in stocks. Not even close. The stock dollar is far louder, more volatile, and dominates the portfolio’s mood swings.

So, how do you actually build one? The methods range from surprisingly simple to mathematically intense. Let’s walk through them.

Basic Risk Parity Construction: The Naïve Leverage Approach

This is the starting point. Imagine you have two assets: stocks (high risk) and bonds (low risk). In a dollar-weighted world, stocks dominate the risk. To equalize, you need to de-risk the stocks or boost the bonds.

Here’s the deal: since lowering stock exposure defeats the purpose of seeking return, the common lever is to borrow money to buy more bonds. This is the leverage part that makes some investors twitchy. You might end up with a portfolio that looks like 30% stocks and 70% bonds, but because you’ve leveraged the bonds, their risk contribution is cranked up to match the stocks.

- Step 1: Estimate volatility. Look at historical standard deviation for each asset.

- Step 2: Find the inverse. Allocate so that (Allocation A * Volatility A) ≈ (Allocation B * Volatility B).

- Step 3: Apply leverage cautiously to the lower-risk asset to achieve balance and target return.

It’s straightforward but, you know, a bit crude. It assumes volatilities are stable and ignores how assets interact—which is a huge piece of the puzzle.

The Gold Standard: Variance-Based Risk Parity

This is where we get serious. This method doesn’t just look at individual volatility; it dives into the relationships between assets using covariance and correlation. It answers: “How do these assets move together in a storm?”

The math targets equalizing each asset’s contribution to the portfolio’s total variance. You’re solving for weights where the marginal risk contribution is identical across the board. Honestly, you’ll likely use an optimizer or specialized software for this—doing it by hand is a headache.

The big advantage? It handles diversification benefit explicitly. If two assets are highly correlated, they’ll get lower weights because together they’re riskier. If they zig when the other zags, they might get promoted.

Key Inputs You Can’t Ignore

| Input | What It Is | The Pain Point |

| Expected Volatility | How much an asset price swings. | Past volatility is a terrible predictor of the future. Markets change. |

| Correlation Matrix | How asset returns move together. | Correlations tend to spike toward 1 (crash together) in crises—just when you need diversification most. |

| Leverage Cost | The interest rate on borrowed funds. | In a rising rate environment, this can crush the return of levered bond positions. |

Beyond Stocks and Bonds: The Multi-Asset Playground

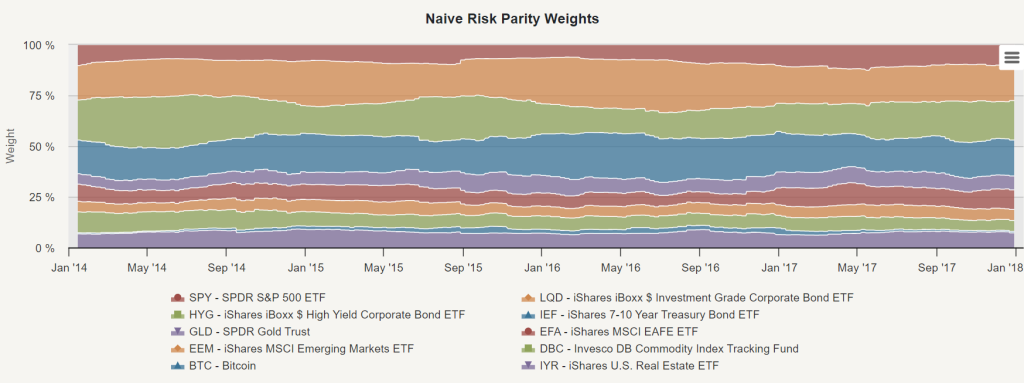

Modern risk parity strategies rarely stop at two assets. They often incorporate commodities, inflation-linked bonds (TIPS), real estate, and sometimes even currencies. The construction method gets more complex, but the principle holds: equalize risk contribution.

This is where you see the real magic—or the real challenge. Adding assets with different return drivers can smooth the ride. But it also introduces more estimation error. You’re forecasting more volatilities and more correlations. It’s a classic trade-off: complexity versus robustness.

Common Pitfalls & The Human Touch

Sure, the math is elegant. But building a risk parity portfolio in the real world is messy. Here’s what often gets overlooked.

Leverage is a double-edged sword. It amplifies gains but also losses and costs. In a sustained bond bear market with rising rates—a scenario we’ve entered—the levered bond portion can suffer significantly.

Input sensitivity. Garbage in, garbage out. Small changes in your volatility or correlation estimates can lead to wildly different portfolio weights. That’s why many practitioners use long-term averages or robust estimation techniques, not just last year’s data.

And then there’s the human element. A pure risk parity model might tell you to put 50% of your risk budget into an asset you have zero conviction in. Do you follow the model blindly? Or do you overlay judgment, creating a risk-aware portfolio rather than a dogmatically risk-parity one? Most real-world implementations choose the latter. They use the framework as a guide, not a god.

So, Is It Right For You?

Risk parity portfolio construction methods offer a profoundly different lens. They force you to think in terms of risk first, returns second. For an investor sick of their portfolio being hostage to equity market tantrums, that’s a liberating shift.

But it’s not a free lunch. It requires comfort with leverage, sophisticated modeling (or trusting a manager who does it), and acceptance that in raging bull markets for stocks, you’ll almost certainly lag. You’re building for resilience, not for winning the short-term performance race.

In the end, risk parity isn’t just a set of calculations. It’s a philosophy of humility. It admits that the future is unpredictable, so the best we can do is ensure no single bet—no matter how safe it seems—can sink the ship. That’s a thought worth considering, no matter how you ultimately choose to invest.