Stock Trading Strategies That Will Help You Succeed

3 min read

If you are new to stock trading, a great stock trading strategy is to buy and sell stocks with limited risk. You can practice scalping by accepting smaller gains on every trade. Be careful not to get greedy and to hold on to winning trades for too long, as the market is volatile and can quickly change. Listed below are some of the stock trading strategies that will help you succeed. Try them out today! You may be surprised!

In this stock trading strategy, you should only hold positions that can outperform. A proper buy point is over $15, and the volume should be at least 200,000 shares per day. Also, you should avoid oversold zones, as they are a risky place to invest in. However, the rewards could be huge. Besides, the strategy is best suited for small positions, as it does not require too much risk. If you follow these tips, you are sure to succeed in stock trading.

Besides, you should constantly monitor your own performance. You must also analyze lost trades, and study your winning and losing trades. No stock trading strategy can guarantee a profit in every trade. Remember that your goal is to win more than you lose, and you need to build your winning streak over time. To achieve this, you must use a platform that offers the most value for your money. If you want to invest in stocks, this is a great way to get started. You can also use a stock trading strategy to earn extra money from home.

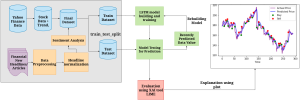

In this strategy, you use the MACD indicator to measure the strength of price movements. The MACD boundaries are at the highs and lows of each time interval. The MACD and the signal line oscillate in tandem with the stock price, and you should look for crossovers. Crossovers between the MACD and the signal line indicate a change in momentum. A crossover means the price is likely to move upward, while a cross below the SMA signals a decline. Another stock trading strategy is using the stochastic oscillator. If the two lines cross, you should buy.

Trend following stocks can be profitable without the need for extensive research into company management. Instead, all you have to do is identify stocks that are rising in price, and these stocks likely have strong management teams and attractive fundamental conditions. The price earnings multiple (PE) is a good indicator of investor sentiment. The higher the PE multiple, the more confident investors are. This will result in an upward trend in share price. This type of stock trading strategy has the potential to produce high double digit returns.

When trading on margin, you should monitor margin volume and the price. You can see how much stock is trading on margin, and you can adjust your margin and trade accordingly. You should also keep an eye on your stock’s volume to ensure that it is in a profitable position. However, don’t forget to close positions before the price reaches a fixed threshold. You don’t want to end up in a position where you can’t get back on the horse!