Risk Management in Forex Trading: Protecting Your Capital

4 min readDo you trade in the Foreign Exchange Market, commonly known as Forex? Did you know risk management is as essential to guarantee success as a great trading strategy? Risk management is an integral part of any successful trader’s arsenal, and understanding how to manage risk best when trading in this sometimes volatile market can spell the difference between financial success and disaster.

In this article, we will take a comprehensive look at the various tools available for Forex traders and discuss practical strategies for protecting your capital and increasing your chances of becoming successful. Through proper risk management techniques, you’ll gain valuable insights into how best to approach trades while mitigating excessive risks that may cost you profits in the long run.

What is Risk Management in Forex Trading and Why You Should Care

Forex trading is an exciting venture that can bring in substantial profits. However, every trader should come to terms with the fact that the market is inherently risky. Therefore, it is essential to have a solid risk management framework to help minimise potential losses. Risk management is a process of identifying, analysing, and controlling risks that could negatively affect your trading account. It could involve setting stop-loss orders, diversifying your trading portfolio, and calculating the risk-to-reward ratio of each trade.

By implementing an effective risk management strategy, traders can protect their capital and ultimately increase their chances of overall success. So, dear trader, always appreciate the importance of risk management in forex trading. Check out Saxo for more information on risk management in forex trading.

The Three Pillars of Risk Management – Managing Your Money, Controlling Your Emotions and Knowing When to Quit

Effective risk management in forex trading can be broken down into three main pillars: managing your money, controlling your emotions, and knowing when to quit. Let’s look at these pillars and why they are crucial for successful trading.

Money management is all about preserving capital and limiting potential losses. It involves setting realistic goals for profits and losses, maintaining a trading journal to keep track of your performance, and using appropriate position sizes for each trade. Proper money management ensures you don’t risk too much on any single trade, allowing you to stay in the game even during losing streaks.

Controlling emotions is another critical aspect of risk management. Fear, greed, and overconfidence are common emotions that can lead to impulsive and potentially harmful trading decisions. By staying disciplined and following a predetermined trading plan, traders can avoid emotional trading and stick to their risk management strategy.

Finally, knowing when to quit is an essential component of risk management. It means setting stop-loss orders for every trade and being disciplined to stick with them, even if the market goes against your predictions. It also involves having a predetermined exit point or profit target to avoid getting caught up in the temptation to hold on for more significant gains.

Develop an Investment Plan with Stop Loss and Take Profit Orders

One of the most effective ways to manage risk in forex trading is by developing an investment plan that includes stop loss and take profit orders. These two orders can help you limit potential losses and lock in profits.

Stop loss orders are a level at which your trade will automatically be closed if the market moves against you. It lets you define your maximum loss for any trade and protect your capital. On the other hand, take-profit orders are set at a predetermined price level that you would like to exit the market when reached. It allows you to lock in gains and avoid the temptation to hold on for even more profits.

Utilising Leverage Wisely – Managing Risk Exposure and Margin Calls

Leverage, or trading on margin, is a tool that can amplify your potential profits in forex trading. However, it can also increase your risk exposure and potentially lead to margin calls if not managed correctly. Therefore, utilising leverage wisely as part of your risk management strategy is crucial.

One way to manage leverage risk exposure is by setting appropriate stop-loss orders. It ensures that your losses are limited to a certain amount even if the market moves significantly against you. It is also essential to stay within your risk tolerance level and only use leverage on trades with a high probability of success.

Another critical aspect of managing leverage is being aware of margin calls. A margin call occurs when the value of your account falls below a certain threshold, usually set by your broker. In such cases, you may be required to add more funds to your account or risk having your trades automatically closed out, potentially resulting in significant losses.

Hedging Strategies for Increased Gains in Forex Trading

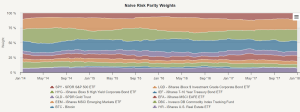

Hedging is a risk management strategy that involves opening multiple positions to minimise the overall risk in your trading portfolio. It can be achieved using correlated currency pairs or complementary instruments such as options or futures contracts.

One common hedging technique used by forex traders is known as a “long-short” hedge, where they simultaneously hold both long and short positions on two different currency pairs that are highly correlated. It allows them to minimise their risk exposure while still potentially profiting from market movements.